List Of PAG IBIG Loans For OFWs (Overseas) 2023

Although Overseas Filipino Workers (OFWs) do not earn a high salary, they work hard to provide for their basic needs and those of their families. In addition to saving for future expenses, they often face difficult circumstances and look for additional sources of income.List Of PAG IBIG Loans For OFWs (Overseas) 2023 PAG IBIG is a reliable organization that provides financial support to OFWs, more so than other banks. The PAG IBIG loan can be used for various purposes such as managing their homes, education, and working capital.”Despite being hardworking citizens, Overseas Filipino Workers (OFWs) struggle to earn a substantial income and often face challenges in acquiring basic necessities for themselves and their families. In addition to their daily needs, they also have to save money for unexpected expenses. Due to these circumstances, OFWs often seek out additional sources of income. PAG IBIG is a highly trusted corporation that offers financial support to OFWs and is more accessible to them than other banks. Our provided PAG loan can be used for various purposes such as managing a home, funding education, and providing working capital.”

List Of Pag-IBIG Or HDMF Loan

Payday Loan Of PAG IBIG:

Payday loans are a unique type of expense that differs from routine tasks, as they include funding for urgent needs such as medical care, vehicle repairs, and other unforeseen financial requirements. As a result, many Overseas Filipino Workers (OFWs) are drawn to payday loans with low-interest rates. These loans offer easy repayment methods and flexible refunding options, making them more accessible than other types of loans.

Multiple Purposes-Pay day Loan Of PAG IBIG:

Different loan types come with their own specific terms and conditions. It is important to carefully consider the loan that best suits your needs. The amount you can borrow depends on your net assets and income requirements, and you must decide whether you need the funds for emergency purposes or long-term payments.

For Overseas Filipino Workers, it is crucial to analyze the interest rate and annual amortizations before taking out a loan. By obtaining reliable information, you can avoid penalties and make informed decisions about your finances. Additionally, you may be able to receive a payroll loan within 1-2 weeks with short repayment periods of up to 24 months.

Tips For Achieving The Approval Of PAG IBIG Loan

OFW Must Maintain A Stable Job:

When applying for a housing loan with PAG IBIG, it is necessary to submit valid documents and demonstrate a stable income source. The stability of your income and job are crucial factors in obtaining a loan. Having a consistent job increases your likelihood of being approved for a loan.

Clarify Your Overdue Payments Of The PAG IBIG Loan:

If you have previously made contributions to PAG Agency, it may be beneficial to consider using their services again for your next agreement. To increase your chances of loan approval, it’s important to ensure that your previous contract was free of any defaults, cancellations, or penalties. If your account has received acceptable notifications and all payments have been made, this will improve your likelihood of being approved for your next loan.

Apply According To Accurate Property Rates:

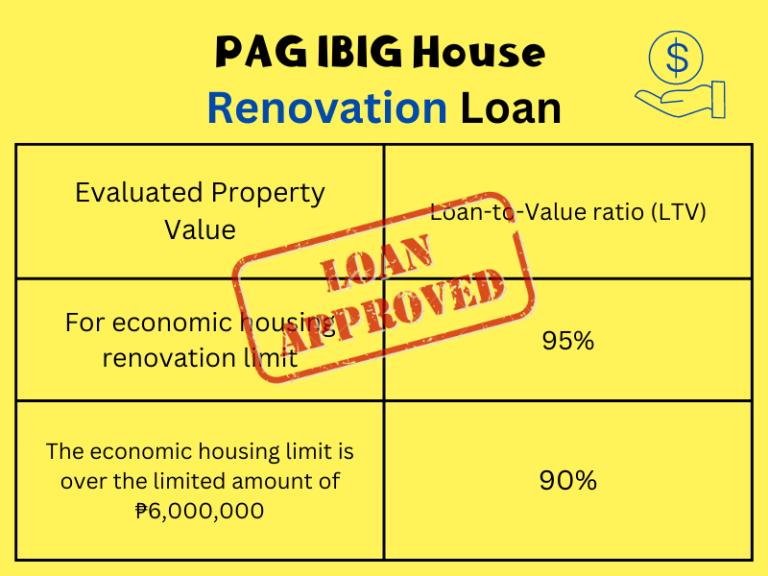

“You have the option to apply for a qualified loan amounting up to six million PHP. To be eligible for this loan, you must provide your property’s desired charges slip. Once you have prepared the genuine forms and rates for your property’s location, your loan payments will be confirmed.”

Co-Borrower Consideration:

At times, individuals who borrow money may feel uncertain about paying back large loan installments. One solution is to apply for a loan with a co-borrower. If the co-borrower has a strong credit history and steady employment, both parties can take advantage of PAG membership in a suitable and beneficial manner.

Additionally, HDMF is a reliable agency that offers loan services to OFWs and other workers. To become a member, ensure that your documents are verified and submit

your application.

The explicit purposes are enlisted for the PAG housing loan.

PAG IBIG Loan For Multi-Purposes–Purposes:

To begin with, IBIG should be regarded as a housing program established by the government that offers loans based on the salaries of overseas Filipino workers (OFWs) and property information. OFWs need to complete the necessary requirements to qualify for interest rates. PAG IBIG provides a flexible loan that can be utilized for various purposes, and you can even obtain competitive payments that cover your household expenses.

If an OFW has obtained a loan for multiple purposes, the net amount is 750,000 Pesos. PAG IBIG creates a convenient amortization plan for you, where you can choose to make 5600PHP repayments for a duration of thirty years.

The PAG organization is considered more reliable than other loan providers. This gives you the opportunity to receive a significant bonus while meeting your housing needs. Additionally, you may pay off your loan installments earlier than the specified time.

Loan For Short-Term Programs:

This offer from PAG is known as a short-term loan or MPL, which stands for “Multi-Purpose Loan.” It is designed to assist borrowers who require emergency funding. With MPL, you can obtain up to 80% of your loan amount to fulfill urgent financial obligations. This mandatory payment can be processed within two days only. One of the significant benefits of a PAG IBIG loan is the accessibility of your regular savings at any time, particularly in cases of urgency.

MPL is typically utilized for pressing financial requirements, such as: